WORRIED ABOUT

SWITCHING COSTS?

Switching costs does not have to be complex. FXFlow provides

full support and guidance, making the process straightforward

and minimising disruption.

Switching costs does not have to be complex.

FXFlow provides full support and guidance,

making the process straightforward and

minimising disruption.

Switching costs does not have

to be complex. FXFlow provides

full support and guidance, making

the process straightforward

and minimising disruption.

NEW!

STREAMLINE YOUR

FX PAYMENTS

STREAMLINE YOUR

FX PAYMENTS

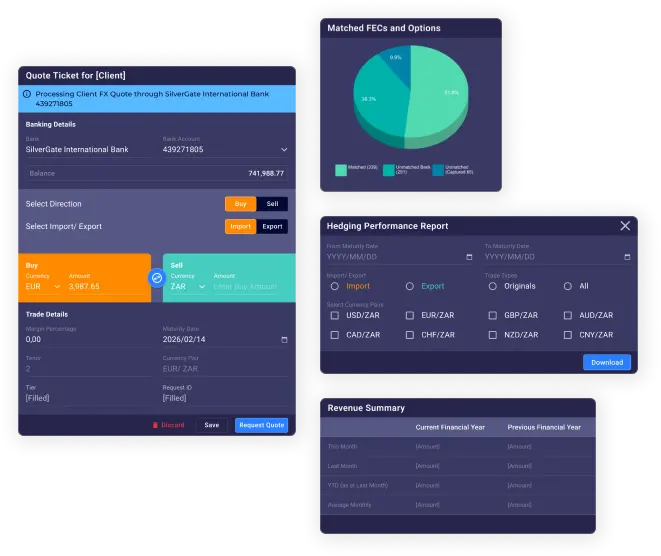

FXPay gives you instant, secure processing of payments

and receipts with full automation and bank integration,

reducing errors and manual work.

FXPay gives you instant,

secure processing of payments

and receipts with full automation

and bank integration,

reducing

errors and manual work.

HASSLE FREE FX

RISK MANAGEMENT

HASSLE FREE

FX RISK

MANAGEMENT

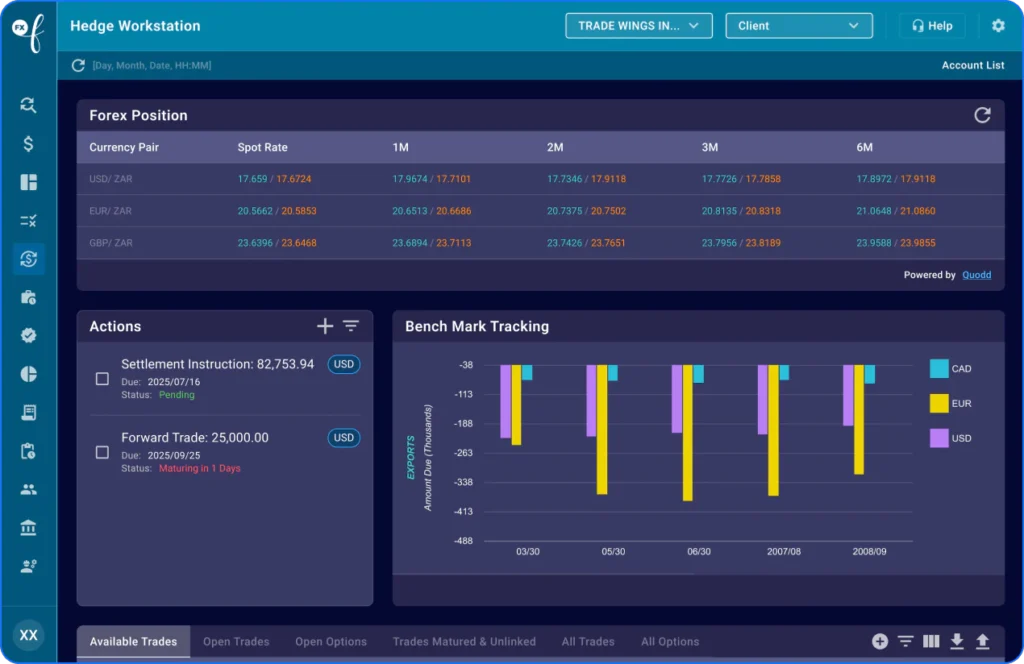

Empower risk managers to make smarter strategic

decisions by tracking exposures and managing hedging

activities in a dynamic and transparent environment.

Empower risk managers to make

smarter strategic decisions by

tracking exposures and managing

hedging activities in a dynamic

and transparent environment.

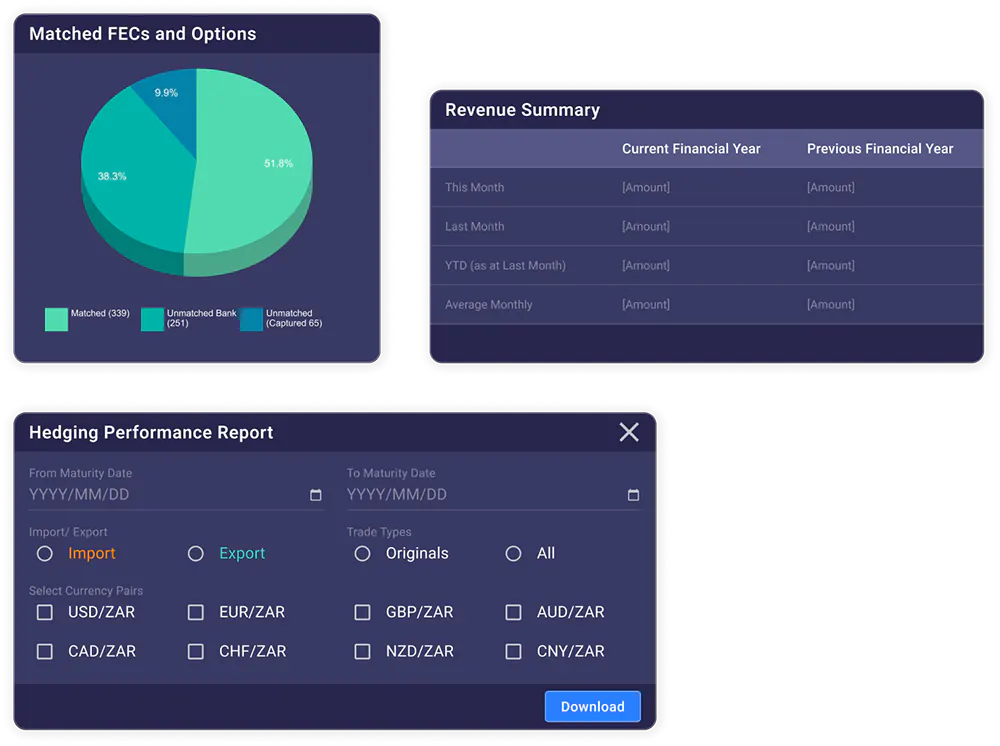

BUILT WITH TOCs

FOR TOCs

Streamline master data management of client

and partner information and automate revenue

share as well as month-end reporting.

Streamline master data

management

of client and

partner information and

automate revenue share as

well as month-end reporting.

FREE TRIAL

AVAILABLE NOW!

Sign up for a free trial period and experience

the power of the FXFlow Platform’s advanced

Risk Management Capability

Sign up for a free trial period

and experience the power of the

FXFlow Platform’s advanced

Risk Management Capability

Imagine a world where you can trade volatile currency pairs like USD/ZAR with absolute confidence, where forward planning and proper costing are no longer hurdles but stepping stones to greater profitability. Where the execution of international payments is simple and secure, where BOP forms are autogenerated, and payment instructions are integrated into your bank’s API.

Smarter Forex.

Seamless Execution.

Built for Your Business.

Step into the future of forex with FXFlow – where a frictionless experience helps your business thrive in an ever-changing market.

OUR UNIQUE ATTRIBUTES

OUR OFFERING

FXFlow is purpose-built to deliver tailored solutions that meet your unique business model and specific requirements.

Our FXRisk, FXPay and FXIntermediary modules seamlessly integrate to offer a comprehensive, end-to-end solution for you and your clients. Whether you’re navigating global trade, managing corporate finances, or facilitating currency exchange, our solution empowers you to manage the entire FX process with confidence and precision, achieving growth, streamline operational efficiency, and eliminate losses.

PARTNER WITH FXFLOW

FXFlow is part of the 42Markets Group, a specialist FinTech Group, whose companies have decades of experience and deep expertise in Trade and Treasury in Financial and Capital Markets.

FXFlow is part of the 42Markets Group, a specialist FinTech Group, whose companies have decades of experience and deep expertise in Trade and Treasury in Financial and Capital Markets.